Start-Ups & SMEs

Merck’s immuno-oncology blockbuster was the world’s best-selling drugs by revenues for the second year in a row, with an almost $12bn lead over its closest rival, Novo Nordisk’s GLP-1 drug Ozempic.

The German group is spinning off from Eckert & Ziegler and listing in Frankfurt, though a leap to the NASDAQ will likely follow once it has more data on a lymphoma theranostic.

BridgeBio spun out oncology assets in May to focus on rare diseases and now it has sliced off a few rare disease candidates for GondolaBio. Also, Avidity and Kymera closed follow-on offerings that grossed $345.1m and $225m, respectively, and Vandria extended its series A round to $30.7m.

With $150m in series A funding, the Versant- and Novartis-backed start-up is betting it can overcome the challenges to getting RNA medicines into the kidney.

The start-up launched last year with Phase III-ready upacicalcet, which has nearly completed two pivotal trials in secondary hyperparathyroidism and for which it has exclusive rights outside of Asia.

Emerging Company Profile: Backed by Flagship Pioneering, Empress deploys its Chemilogics platform to seek leads for small molecule therapies in inflammation, immunology, cancer and metabolic disease.

Discontinuation of the AML study created concern about potential readthrough to a pivotal MDS trial, but the company and analysts pointed out differences in the diseases.

Francesco Hofmann, head of R&D at the mid-sized French group, tells Scrip that its strategy of not playing in the spaces that are dominated by big pharma is paying off.

Nemluvio is a first-in-class IL-31 inhibitor that the US FDA approved for prurigo nodularis.

Halda will take its first RIPTAC molecule into a clinical trial in prostate cancer, offering a new small molecule modality in an indication where patients and doctors prefer oral drugs.

Private Company Edition: Symbiotic Capital emerged with a $600m-plus fund to provide credit for private and public companies, while venBio raised a $528m fund. Also, Outpace Bio raised $144m, Jade Biosciences launched with $80m and MBX Biosciences raised $63.5m.

The UK firm is weighing up its options for late-stage development of LEVI-04 after unveiling positive Phase II results of Phase II for the neurotrophin-3 inhibitor in moderate-to-severe osteoarthritis.

Deal Snapshot: The Swiss major has given Sangamo a cashflow injection in a deal to access two novel technologies to develop treatments for neurodegenerative diseases, including against tau for Alzheimer's.

It remains extremely challenging to raise money for start-ups in the neuroscience space that still have little data but the commercial possibilities for those investors prepared to take a punt are huge.

Private Company Edition: Venture capital investment has moved into a slower summer pace, or maybe just shifted to small- and medium-sized biopharma financings. In addition to Third Arc’s $165m series A round, Brenig raised a $65m series A and Confo’s series B totaled €60m ($65m).

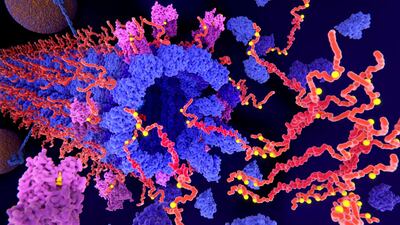

Big biopharma is struggling to find the next generation of cancer immunotherapies, but the sector’s smallest companies might just have the platforms of the future.

Adding Oxford to its roster will help Apollo widen its net for potential first-in-class therapies, and connects with the university’s ambition to build world-beating spin-outs.

Sepranolone may have progressed positively through a Phase IIa trial but its potential to reduce tics has failed to tempt any of the 20 or so potential partners that the Swedish biotech spoke to about a licensing deal.

Flush with cash, the controlling stakeholder of Novo Nordisk’s life sciences investment arm is increasing its financing of other biopharma innovators.

New modalities and potential best-in-class challengers have excited investors in 2024 to date, but companies whose drugs have underperformed on the market have been punished.